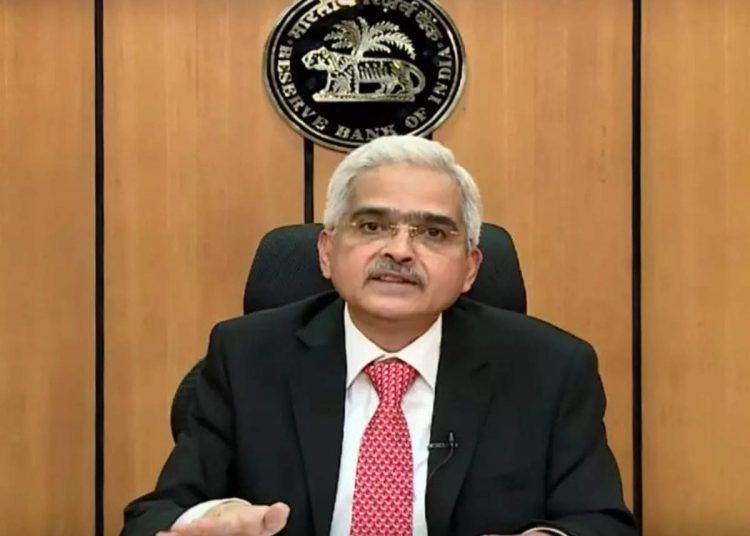

Despite rising concerns about the Omicron variant of the Coronavirus pandemic, RBI governor Shaktikanta Das emphasized continued policy support, which was echoed by members of the financial institution’s financial coverage committee (MPC) during their meeting earlier this month to take a call on key lending charges. Mr. Das indicated in the minutes of the MPC meeting, which took place between December 6 and 8, 2021, that uncertainty is rising as the only certainty amid rising Omicron variant instances in the country and their potential impact on the financial system. After three days of deliberations at the RBI’s Mumbai headquarters, all MPC members unanimously decided to keep the repo and reverse repo charges intact.

According to him, there are two important takeaways for central bankers from these developments. “First, unpredictability appears to be the only certainty that central bankers will have to contend with in the near future.” Second, because monetary policy is at a crossroads, the path of monetary policy, which is already difficult in the best of times, will become even more difficult,” he noted in the minutes. He noted that the Indian economy is facing a number of headwinds arising from international factors, some of which are old and have been extended in comparison to the preliminary assessment, as well as new ones.

West Bengal Government Plans to Remove Governor from Chancellor’s Post to Make Way for CM

“Given these uncertainties, continuing policy support is necessary for a lasting, broad-based, and self-sustaining rebound,” the governor stated, “particularly to promote revival in lagging sectors and to shield those who are susceptible to shifting headwinds.” Shashanka Bhide, Ashima Goyal, Jayanth R Varma, Mridul K Saggar, Michael Debabrata Patra, and Shaktikanta Das, all members of the MPC, voted unanimously to hold the policy repo rate at 4%.

With the exception of Mr. Varma, all members voted to maintain the accommodative stance for as long as it was necessary to revive and sustain growth on a long-term basis, as well as to continue to mitigate the impact of the Coronavirus pandemic on the economy while ensuring that inflation remained within the target going forward.